is there a death tax in texas

Federal estate taxes do not apply to. Each of the following transactions is subject to the 10 gift tax.

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The vast majority of us more than 99 wont stand to ever pay an estate tax. Cons of death tax.

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. Property tax in Texas is a locally assessed and locally administered tax. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

There is a 40 percent federal tax however on estates over 534. Estate taxes and inheritance taxes. Inherited Motor Vehicles Taxable as Gifts.

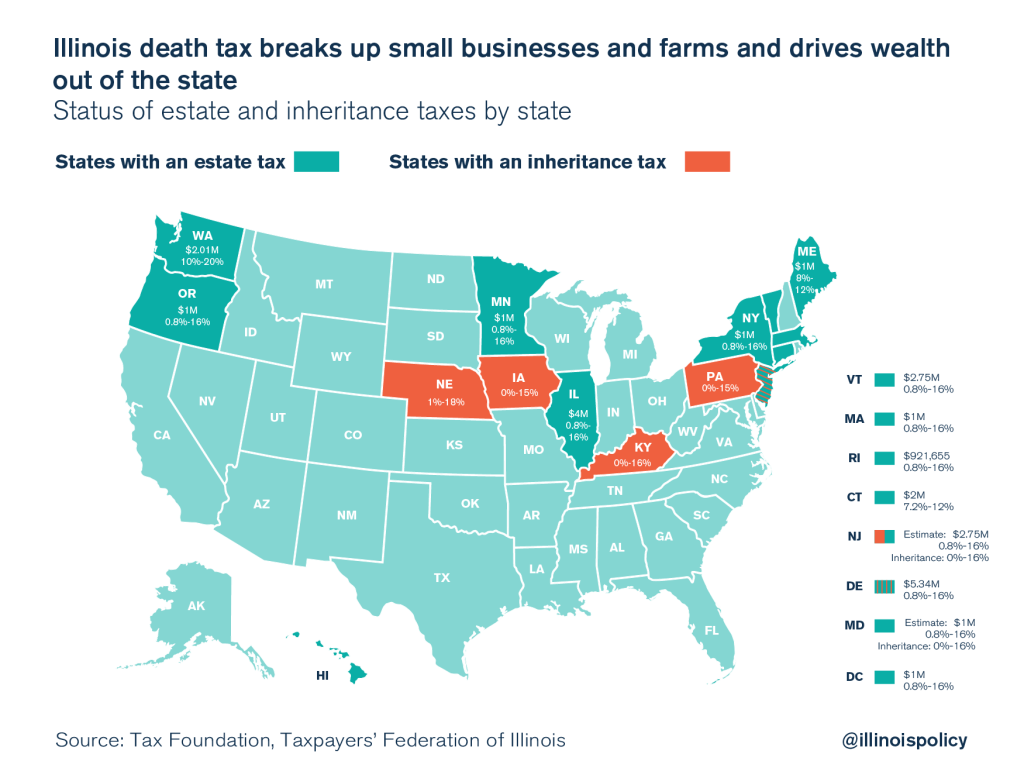

Only 12 states plus the District of Columbia impose an estate. To a total property tax exemption on his or her residence homestead if the surviving spouse has not. It is one of 38 states that do not have an estate tax.

Like the inheritance tax there is no estate tax in Texas. Estate Tax in Texas. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after.

What Is the Estate Tax. There is no. Taxes levied at death based on the value of property left behind.

Federal exemption for deaths on or after January 1 2023. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million. Call or Text 817 841-9906.

There is a Federal estate tax that applies to estates worth more than 117 million. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. Is There A Death Tax In Texas.

Call our estate planning attorneys to learn more. No not every state imposes a death tax. There is a Federal estate tax that applies to estates worth more than 117 million.

The federal estate tax disappears in 2010. This final tax isnt anything that you or your estate would be. There are two main types of death taxes in the united states.

Receipt of an unencumbered inherited motor vehicle as specified by a deceased. While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. The big question is if there are.

The Estate Tax is a tax on your right to transfer property at your death. Book a Consultation 512 410-0343. Live Call Answering 247.

Although theres no estate tax in Texas you still might have to pay federal estate taxes. The federal estate tax is a tax on your right to transfer property at your. Death Taxes in Texas.

The death tax is only hitting the wealthiest Americans.

Free Report What Are The Gift Tax Exclusions Vermillion Law Firm Llc Dallas Estate Planning Attorneys

Spring Texas Property Taxes Real Estate Taxes Discover Spring Texas

/https://static.texastribune.org/media/images/2016/01/28/marijuana_stamps.jpg)

Analysis The Death Of Taxes On Illegal Drugs In Texas The Texas Tribune

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

State Estate And Inheritance Taxes Itep

Federal Tax Changes Could Pressure Illinois To Repeal Death Tax

Art Law On Estate Tax On Inherited Collections Artnet News

Is My Wrongful Death Settlement Taxable Buzbee Law Firm

Texas Inheritance Laws What You Should Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Death Tax How Money Walks How 2 Trillion Moved Between The States A Book By Travis H Brown

Death Tax Instant Equipment Expensing In Final Tax Reform Plan Texas Farm Bureau

Over 65 Property Tax Exemption In Texas

How Do State Estate And Inheritance Taxes Work Tax Policy Center